01

Dec 2011

Labor Strike Tactics in China

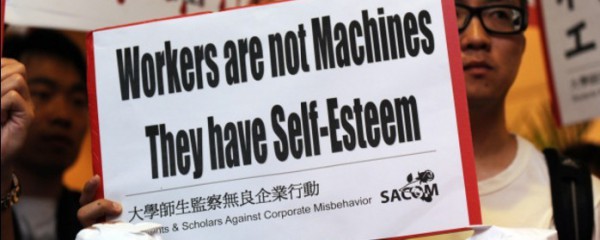

Increasing labor costs have become a major concern for foreign companies mulling whether or not to invest in China, but this may not be the only labor-related issue they should be watching out for. As the recent global economic downturn brings about falling factory orders, an abundance of young, well-educated and computer-savvy Chinese workers are leading one of the country’s strongest waves of labor unrest and labor disputes, which could cause real damage to companies’ regular day-to-day operations.

Intensified labor unrest

Over a one-week period in mid-November, more than 10,000 workers in Shenzhen and Dongguan – the two leading export hubs in South China’s GuangdongProvince – went on strike.

Some 7,000 workers demonstrated against an overtime work cut and relocation plans at a Dongguan-based Taiwanese shoe factory owned by Pou Chen which supplies footwear to Nike and Adidas. At another Dongguan-located large-scale shoe factory Yue Yuen Industrial Holdings – a major supplier for the sports brand New Balance – some 8,000 workers held a violent strike, blocking roads and overturning cars, according to a Reuters report.

Strikes have also taken place at the Hong Kong-listed underwear factory Top Form, where hundreds of female workers protested against a pay cut, and at Apple’s major keyboard supplier Jing Mold Electronics Technology, where middle managers complained about working late hours for which they were not properly compensated.

Geoffrey Crothall, web site editor of China Labor Bulletin (CLB), a Hong Kong-based labor advocacy group, commented that the recent intensification of labor unrest is the “most significant spike in unrest since the summer of 2010.”

The “summer of 2010” Crothall referred to was the time when a string of labor protests – involving over 2,000 workers – occurred at eight companies across the country owned by (or supplying) Japanese automakers, including Honda and Toyota.

The strike at Nanhai Honda – which triggered a series of labor protests last year – finally won workers a 33 percent pay-raise during that year, from the original RMB1,544 per month to RMB2,044. Earlier this year, the company took the initiative of offering another raise of RMB611 towards workers’ salaries.

Reasons behind strikes

For the time being, the state of the global economy coupled with high inflation (which simply increases livelihood pressures) in China, have been regarded as major contributors to the new wave of labor unrest. However, in general, employers should get more prepared for an increase in labor issues, as a younger generation of workers with a higher education are starting to gain a better sense of their labor rights.

Reduced Western orders

Guangdong Province, China’s export powerhouse, is perhaps most affected by the Western economic woes. The province has witnessed a 9 percent drop in October’s exports, mainly caused by a collapse in orders from debt-ridden European countries, according to Zhu Xiaodan, Guangdong’s acting governor. The flash purchasing managers’ index recently compiled by HSBC has also indicated a slowdown in the country’s manufacturing sector.

The reduced overseas orders are forcing employers to cut overtime work hours, which ultimately leads to a pay cut for workers. China’s factory workers – who usually see a low basic salary – often count on the extra pay they can receive through working overtime. According to CLB statistics, the average basic monthly wage for an electronics worker is about RMB1,500, but rises to RMB2,500 with overtime.

If the global economy continues to trend downwards, more and more manufacturing workers may face redundancy. A recent estimation by the Federation of Hong Kong Industries said one-third of some 50,000 Hong Kong-owned factories could downsize or close by the end of the year, indicating thousands of migrant workers could face losing their jobs.

A growing number of laid-off factory workers will hurt China’s social stability, an essential factor that will eventually impact business operations in the country.

“Massive factory layoffs will lead to increased protests and social turmoil in China’s urban and rural areas, spurred on especially by those laid-off factory workers and other migrant laborers particularly marginalized by society,” warned Li Qiang, founder of the U.S.-based labor advocacy group China Labor Watch.

Inflation

Employers in China are feeling increasing cost pressures during this period of high inflation. The tightening environment has had a dramatic effect on the cash flows of many companies, forcing them to trim labor pay or cut back on the number of employees.

Some companies located in China’s costly coastal cities may even be considering relocating to inland China, which often becomes an issue the workers center on during their protests. Most younger migrant workers prefer to live in those bustling coastal cities and are also concerned about how they will be treated after the relocation, Crothall pointed out.

While cash-strapped companies tighten their wage overheads, workers are further pushed to stand up, as the surging consumer prices have seriously impacted on their living standards.

“We are willing to work, but you must also pay us enough to survive, to guarantee the basic quality of life,” said one woman interviewed by Reuters protesting outside Yue Yuen Industrial Holdings.

Seeing the mounting risks of social instability, China has urged its local governments to lift their minimum wage levels. The city of Shenzhen – where a massive amount of migrant workers gather to work – has recently announced a plan to lift its minimum monthly wage from the current RMB1,320 to RMB1,500 starting in January next year.

However, the hikes in minimum wages do not seem like a perfect solution to the labor issues, as many employers – especially the ones struggling to maintain profits – have taken other avenues to save costs, which still eventually hurt workers’ interests.

A new generation leading the way

It is worth noting that, in general, tensions in China’s labor relations are rising because of the increasing dominance of a new generation of migrant workers.

A recent CLB report listed a string of new characteristics the new generation of workers boast:

– Better education;

– Less experience doing agricultural work;

– Higher recognition of an urban lifestyle; and

– Increased access to internet and mobile communications

With these characteristics, the new generation of workers – now taking up 60 percent of the total migrant worker population – is generally less tolerant of employer abuse, low pay and poor working conditions, and are more likely to stand up for their rights.

The improved access to the Internet – which makes instant information exchange possible – can sometimes expand one single protest into broader industrial actions. Last year, a wave of strikes in China’s northern city of Dalian hit 73 enterprises and involved over 70,000 workers demanding higher wages.

The availability of various social networking tools has also helped workers to better organize protests. With these high-tech tools, they can upload real-time updates on the progress of strikes, enable reporters to track events, and have lawyers/labor rights activists to provide professional advice.

The emergence of China’s new-generation of workers has brought the country’s labor relations to a new juncture and is becoming an important lesson for companies to learn from. While Honda has had to make compromises in wages, and Gucci recently had to replace its senior staff at a store after being accused of maintaining sweatshop-like working conditions, the signal being sent is clear. Namely, the days when Chinese companies can maximize their profits through minimum labor expenditures are now fading away.

Cost of labor unrest

Labor unrest can bring about massive company losses, especially for those dependent on a highly complex and integrated supply chain.

According to the CLB report, the Nanhai Honda strike led to the shutdown of Honda’s four vehicle assembly plants in China, and caused daily losses of RMB240 million. It was estimated that total losses during the strike period reached several billion RMB.

Over the same period, the strike at Guangzhou’s Denso – the major power transmission system supplier for Toyota and another 15 vehicle assembly plants – reportedly led to stoppages at six other component suppliers and forced Toyota to close down two assembly lines. Denso’s related downstream auto producers had to suffer a loss of production amounting to 3,600 vehicles per day.

Even for companies that are not so dependent on supply chains – such as some service companies – may pay a price for labor-related issues. When five former employees of Gucci’s flagship store in Shenzhen recently stood out and accused the store of maintaining deplorable working conditions, the French company soon found that the incident has noticeably hurt its brand reputation as it faced public criticism on labor exploitation.

All these costly lessons are reminding employers in China to gain full awareness of the new changes in the country’s labor relations. For newcomers, it is essential to take labor issues into consideration when making investment plans. For existing companies, it is also critical to establish effective mechanisms that help improve work conditions, labor communication, and efficient responses to labor unrest so that losses can be reduced to a minimum level.

Source: http://www.china-briefing.com/news/2011/11/29/watch-out-for-china%E2%80%99s-flaring-labor-unrest.html

– See more at: http://www.sbeintl.com/