20

Jul 2015

CHINA and CHILE FTA

Hello Monday, I bring good news for you! This is about the China and Chile FTA, and the newest update of its FTA (Free Trade Agreement). An avoidance of DTA (which stands for Double Taxation Agreement) was signed last May by the Premier of PRC, Li KeQiang and other delegation of Chinese senior officials went to Chile. On that particular visit, China and Chile also updated their Free Trade Agreement and agreed to set up an RMB clearing centre in Chile.

Let’s dig a little deeper…

This agreement is in line with the latest international tax developments, since it deals with the topic of base erosion and profit shifting (BEPS) – one of the main issues discussed at the most recent G20 meeting. Thus, as China’s State Administration of Taxation (SAT) delegation pointed out, the DTA will balance the countries’ fiscal regulation in order to encourage Sino-Chilean foreign investments.

In addition, the People’s Bank of China (China’s central bank) announced on July 9 that the Chilean branch of China Construction Bank will be designated as offshore RMB clearing bank. This makes Chile the first Latin American country to have an RMB clearing center. In addition, a quota of RMB 50 million will be allocated to Chile in RMB Qualified Foreign Institutional Investor quotas (RQFII). The RQFII program allows stocks in China’s onshore markets to be purchased with offshore RMB. Furthermore, People’s Bank of China announced a three-year RMB 22 billion currency swap deal between the two countries.

To move the strong relationship between the two countries forward, a Memorandum of Understanding to upgrade the 2005 China-Chile Free Trade Agreement (FTA) has been signed. The amendment will mainly increase the number of goods covered, and provide new tax incentives. A joint working team is scheduled to start studying the terms and conditions of the upgraded FTA in August.

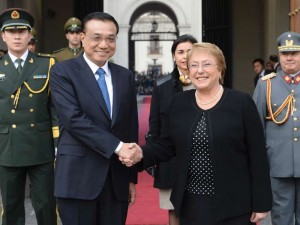

Li KeQiang and Michelle Bachelet

China – Chile Relations

Economic considerations have been a main driver in the relationship between the two countries. While Chile’s GDP of US$ 277.2 billion only amounts to 3 percent of China’s (US$ 9.240 trillion), Chile supplies 30% of China’s copper imports.

The trade between China and Chile has flourished, reaching US$ 34.1 billion in 2014 alone. Some of the most promising industries identified by observers beside coppers and lithium are logging and fishery, as well as the renewable energy, infrastructure and automotive sectors, which are expected to grow by over 30 percent. Also, Chile is now China’s leading provider of bulk wine and its third largest source of bottled wine. Other major agricultural exports – including blueberries, cherries and apples – have been steadily increasing as well.

“Chile has undeniably been on the forefront of South American economies facing China and took the lead in developing commercial ties”, states Ricardo Benussi, International Business Advisory Associate at Dezan Shira & Associates’ Shanghai office. “Chilean entrepreneurs and trade agencies have planted strong seeds deep in the arena of international trade with China and through the resilience of predominant sectors such as their refined copper, ore, wood pulp and acclaimed wines and salmon, trade figures are definitely looking bright, as more Chilean investors are setting up their operations in China, to beef up the already impressive exports to China that count for 23 percent of its global exports.”

“If opportunity doesn’t knock, build a door – Milton Berle”

To read the full story, click Here

For more inquiry, visit http://www.sbeintl.com