04

Dec 2015

BREAKING AIRBUS AND BOEING DUOPOLY

I remember when I was a little kid, my mom taught me when we were inside the airplane that there were only 2 aircraft manufacturers: Boeing from the US and Airbus from Europe; and she preferred Airbus as she felt that Airbus’s aircraft was more spacious than Boeing (oh, dearest mommy *hug*).

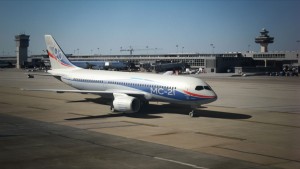

Speaking of which, some countries, mentioning 2 “Big Giants”, Russia and China, want to break that duopoly market. Russia with its state-owned United Aircraft Corporation (UAC) confident to launch its MC-21 aircraft into service in 2017. Following Russia’s, Chinese state-owned plane maker, revealed its C919 plane last November, and in schedule to sail the sky around next year.

Russia’s MC-21

China’s C919

Breaking the Duopoly Market

We have to admit that the Russians and the Chinese may well be fairly good at designing aircraft, but… Their experience in creating the complex production systems and supply chains needed to build them to the extremely high standards of reliability and safety that airlines expect, still need to be developed. Let’s say Bombardier of Canada. It has a good record of safety and quality for their own manufactured smaller aircraft, but they’re still struggling to break into this profitable market.

Recently, Bombardier had tried unsuccessfully to sell a stake in the CSeries project to Airbus. Bombardier announced that the provincial government of Quebec, would pay $1 billion for a stake of 49.5% in the plane, whose development has so far cost $5.4 billion.

Bombardier’s Challenger Aircraft

Incumbents are just as hard to dislodge in the market for smaller regional jets (100 seats capacity), which is dominated by Bombardier and Embraer of Brazil, but which COMAC, UAC’s Sukhoi subsidiary and Mitsubishi of Japan are all trying to break into. Mitsubishi’s MRJ and Sukhoi’s Superjet were delayed by technical problems (on December 2012, there was a Sukhoi Superjet 100 accident in Indonesia).

Fair Game

Well, I think we have had enough to hear the hardships for the duopoly “outsiders” to enter the market. Now, to make it fair, don’t think that Boeing and Airbus don’t have any obstacles. Don’t get it wrong! They also find that it is not easy to take their new aircraft design off the ground. R&D cost is their obstacle. I remember my teacher said that R&D cost is huge, and it’s not only huge, but also 95% of the “fresh from the oven” products R&D result is FAIL.

The R&D costs for Boeing’s newest aircraft project, the 787 Dreamliner, grew to $28 billion as a result of problems with its supply chain and electronics. And revenues from one of Airbus’s newest aircraft, the giant A380, hardly cover its production costs, never mind the capital sunk into its development. If even the industry’s two dominant firms find it a long, expensive struggle to get a new aircraft design in the sky, no wonder their would-be rivals are having such a hard time.

Being the aircraft duopoly “insider” is not easy, everyone… 加油 (jiayou) or in other word, Fighting!

“The sky is not my limit, I am – T.F. Hodge”

Adapted from The Economist